Sustainable business ambitions are facing a range of challenges in a fast-changing global context. In the past year, we have seen a growing recognition of the scale of both the climate and nature crises, geopolitical turmoil, radical changes in energy prices and inflation.

Given this uncertainty, making predictions about what the coming year will hold is (as ever) a difficult business. However, this article considers the main risks and challenges we believe will continue to shape the scope, scale and focus of sustainable business in 2023.

Sustainability has come a long way in recent years. It is no longer uncommon for a company to have a sustainability or ESG ambition and strategy, a clear idea of its material sustainability issues, goals for key areas such as Net Zero and disclosure of performance to key stakeholders.

Despite this progress, there is still much to do, and we are long way from a world where economic and commercial activity has a neutral or positive effect upon the environment or society. So, what might be the main challenges for 2023?

Greenwashing

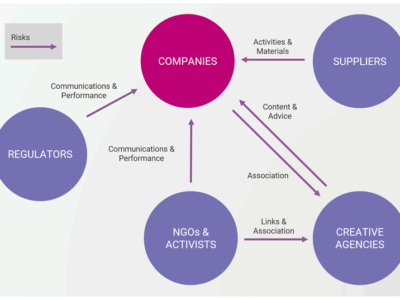

Greenwashing – making inaccurate or misleading claims about the environmental performance of products and services – will be increasingly on the agenda of regulators, businesses, activists, and consumers.

As recognition of the scale of the climate and nature crises grows, so will an understanding of the driving role that consumption plays in accelerating damage. So, more attention will be paid to how organisations are responding. It is more important than ever that we should be able to trust business communications on sustainability. These should include information on the ambition and performance of companies, together with proof that intention is matched by action. At the sharp end of greenwashing, responsible product/service-level information is vital.

During 2021 and 2022, the focus on company messaging has increased, with companies being the focus of greenwashing lawsuits and regulatory action. In the UK, both the Advertising Standards Authority (ASA) and the Competition and Markets Authority (CMA) have taken an active stance to investigate and sanction company greenwashing and this focus is mirrored by regulators in Europe and around the world – a trend that looks to gather momentum in 2023.

Indeed, four days ago (26 January 2023) the CMA announced that it will examine sustainability claims made about a range of FMCG products including food, drink, cleaning products and toiletries. In-store and online claims will be analysed to assess if they conform with UK consumer law. Sarah Cardell, Chief Executive of the CMA, said:

“Our work to date has shown there could be greenwashing going on in this sector, and we’ll be scrutinising companies big and small to see whether their environmental claims stack up. Now is a good time for businesses to review their practices and make sure they’re operating within the law.”

Sustainable business challenges – greenwashing

Increasingly tough and vigilant regulators, together with the demand for better information from customers and consumers will exert greater demands for responsible communications. As ever, the best way to avoid greenwashing is to ensure that your messages are clear, accurate and substantiated, and to make use of the global, and national guidance.

Global Accounting & Disclosure

The momentum for increased consistent, and more regulated accounting and disclosure for climate, as well as wider sustainability issues, has been growing for a few years.

2023 will see several new requirements to measure and disclose start to take effect. Most significant are the recent sustainability standards proposals from the EU/EFRAG, the ISSB and from the SEC, as it’s also worth (in the UK) keeping an eye on the proposed Sustainability Disclosure Requirements (SDR). So, what requires attention?

EFRAG

The European Financial Reporting Advisory Group (EFRAG) – has proposed new mandatory standards for companies within the EU – The European Sustainability Reporting Standards (ESRS). The standards are intended to ensure that corporate sustainability disclosure in the EU not only applies to more companies than under previous regulation (NFRS) but is also more comprehensive, comparable, and relevant. The ESRS currently takes the form of 12 draft disclosure standards, covering requirements for companies to disclose standardised information about how they organise and manage their approaches to sustainability (governance), and their approach to a performance on specific material sustainability topics (e.g., climate, biodiversity, pollution and workforce etc).

ISSB

The International Sustainability Standard Board (ISSB) has issued its two first proposed (draft) standards, one on climate and one on general sustainability related disclosures. Final versions of these standards are expected in early 2023 and the ISSB intends to build upon this foundation with a future focus on other sustainability themes and specific industry sectors. The significance of these developments is the intention of the ISSB to produce standards that will be embedded within international accounting regimes. This means that all companies will be required to assess and disclose sustainability performance in such as manner as to allow financial stakeholders to assess the relationship between sustainability exposures and performance on the value of the company.

SEC

In March 2022 the US Securities and Exchange Commission (SEC) proposed new rules to require standardised climate disclosure for all SEC registrants (the strictness of requirements depend in company size). The proposal requires detailed reporting of governance processes and structures as well as climate-related risks, greenhouse gas (GHG) emissions (Scopes 1, 2 & 3) and Net Zero plans. It is currently unclear when these rules are scheduled to take effect, though they were originally proposed to come into force in 2023.

SDR

The UK Sustainability Disclosure Requirements (SDR) were proposed in October 2022 through a consultation, by the Financial Conduct Authority (FCA). They are investor focused and intended to reduce greenwashing and allow greater clarity for consumers on the sustainability (or otherwise) of investment products. For companies, awareness of how their sustainability disclosures can be understood and interpreted by investors in compliance with the proposed requirements will be key to ensuring whether their activities can be considered as legitimately contributing to sustainable development.

Sustainable business challenges – global accounting and disclosure

Whether they are listed or not, and wherever in the world they operate, almost all larger companies will in some way be affected by these accounting and disclosure initiatives. They will need to review and evolve their current approaches to be able to account for, measure and disclose sustainability performance in 2023. All the developments noted above, align in part or in entirety with the disclosures required by the TCFD (Task Force for Climate-Related Financial Disclosures), meaning that companies that already utilise the TCFD will already be ahead of the game.

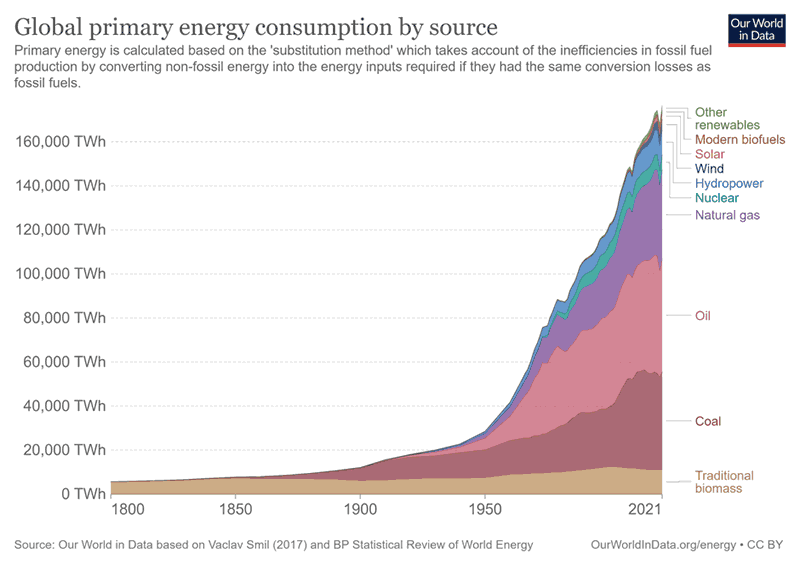

Inflation & cost pressures (including energy)

Inflation isn’t something new, if you’re old enough you’ll remember before the low inflation period we’ve been in for the last 30 years.

During the last months of 2022 central banks worldwide raised interest rates in an almost coordinated manner which has not been seen for decades. This reflects the widespread of inflation but also presents recessionary risks worldwide.

The World Bank suggests there are reductions in supply disruptions and labour supply challenges the global average inflation rate may still be 5%, and therefore in order to cut inflation to targeted rates a further increase of up to 2% in interest rates may be needed.

Inflation is driving input costs for businesses – even while they ‘stand still’. Energy costs are making headlines (and are of course also a significant inflationary driver), but other raw material costs are also rising steeply.

The Conference Board’s C Suite Outlook 2022 asked CEOs and C Suite leaders how they were managing input costs. In order of frequency, tactics included: passing costs downstream, cost cutting, absorbing costs and reducing profit margins, finding cheaper raw materials, changing suppliers and near-shoring supply chains to reduce logistic costs.

A major contributor to inflationary pressure has been the radical increases that the world has seen in the price of gas (with a knock-on effect on electricity prices), driven by recent cold winters and the Ukraine conflict. In the UK, gas and electricity prices rose in 2022 by an average of 45%. In addition to this significant rise, energy prices were markedly more volatile in 2022 than in recent years.

Sustainable business challenges – inflation & cost pressures

Such inflationary pressure and uncertainty about volatile energy and raw material prices (which also have an energy component) are likely to continue to put pressure on the accuracy of business forecasting and production planning.

As energy is a fundamental requirement and embedded input in every product or service, businesses need to make sure they are using as little energy as possible. They are also increasingly requiring their suppliers to demonstrate how they are innovative in reducing energy intensity and minimising costs. In addition, from the other side of the supply and demand relationship, the ability to maintain prices when margins are shrinking, or to raise prices when consumer discretionary spending is under pressure means that businesses will likely face challenges well into 2023 (at least).

Onshoring

The past few years have demonstrated that business models that prioritise efficiency, global supply chains and just-in-time delivery can be vulnerable to global shocks and that previously marginal costs (like shipping and logistics) can soon become material as energy prices rise.

In tandem with these functional challenges, there is also a continuing focus on the social and human rights concerns that come from supply chains which might prioritise low labour costs above transparency and workers’ rights.

We have seen increasing customer emphasis on asking questions about where products are made, with a particular focus on supply from areas where there are recognised human and labour rights issues.

As a result, there is a noticeable trend towards onshoring, bringing production and manufacture within domestic borders, allowing there to be better information on production and labour rights issues, and less vulnerability to transportation and logistics costs volatility.

Sustainable business challenges –sourcing and onshoring

Companies at the top of global supply chains are becoming more vulnerable to human rights and ethics challenges – particularly in the context of their sustainability/responsibility commitments and targets. They may have poor visibility beyond the first or second tiers and are reliant upon these to manage ethical supply performance. As a result, investors, partners, and supply portals & platforms are asking for more detailed information to better understand how supply chains are organised, assessed and managed, especially when riskier locations are involved. Companies need to get better at managing their supply chains for social risk, and to review risks and costs against the origin of supply.

Nature and biodiversity emergencies

COP 15 & TNFD

Many scientists now maintain we are entering the sixth mass global extinction, the largest the earth has seen since the extinction of the dinosaurs. Unlike previous events, this one is driven by human activities such as land-use changes, farming, resource extraction and pollution – all exacerbated by the rapidly heating climate.

However, the world seems to be finally opening its eyes to the nature crisis, as we recognise that not only is there no business on a dead planet, but just how vital functioning natural systems are to tackling climate change, providing clean air and water and as the basis for adequate nutrition.

The UN Biodiversity Conference COP 15 has placed the nature crisis in the headlines and alongside such efforts, there are also emerging approaches to drive how organisations account for and disclose their dependence on and impact upon, the natural world.

Key examples are the TNFD (Task Force on Nature-related Financial Disclosures), which has produced the third beta version of its framework. The goal of the task force is to supply a common framework for the disclosure of nature-related dependencies and risks to allow an understanding of how organisations rely upon and impact nature, and how their ambition and performance relate to financial risks and asset allocation decisions.

Often the link between company activities and biodiversity impacts is remote and complicated, but in other cases clear and direct. As an UK example, the water quality of the River Wye has declined dramatically in recent years. This has been linked to the growth of intensive poultry farming in its catchment. A study by the University of Lancaster suggested that an 80% reduction in manure is needed to protect water quality. The Welsh Government has recently issued a holding order to the local planning authority over a planning application for a new intensive poultry unit that could house 100,000 chickens. Spreading of manure from poultry units is largely outside of regulatory control, but gives rise to pollution of the river and surrounding land (Environmental Audit Committee 2022).

Another area where businesses need to consider the nature-impacts of activities is new EU legislation on deforestation-free products. Political agreement on this proposed legislation was gained in December 2022. The regulations are intended to ensure biodiversity impacts are not ‘imported’ as a result of importing forest-related goods such as coffee, cocoa, beef, soy, palm oil, timber and rubber.

Sustainable business challenges –nature and biodiversity

The need for nature is not going away, a functioning environment is a precondition for a functioning economy. Companies will increasingly be required to understand, measure, and disclose their dependencies and impacts and it will be an ever more important part of the picture for risk management, investment decisions and the cost of capital.

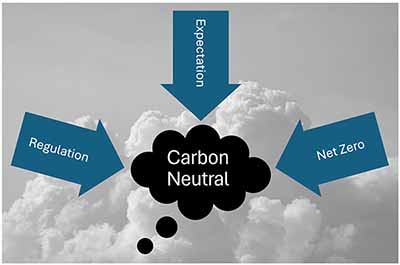

Climate

NASA declared 2022 as one of the hottest recorded years on earth. This is worrying in itself, but there is of course more to come. It also came during a La Niña period of ENSO (El Niño Southern Oscillation) – a period which normally represents a cooler climate phase. The current La Niña began in Spring of 2020 and is predicted to run until perhaps spring 2023 when an El Niño could develop, which coupled with current global temperature trends, could make 2023 even hotter again.

While there is some adaptation to increased global temperatures and more volatile weather, higher temperatures exacerbate drought events and depress crop yields. In 2022 harvests were reduced in Europe, America, India and China. While there have been agreements to allow continued export of grain from Ukraine, the interaction of geopolitical and climate issues only tends to make matters worse.

Against this background, there’s growing recognition that the UN COP (Conference of Parties) process is failing to deliver the impetus for change needed to mitigate damaging climate disruption. While the Paris Agreement set targets for ‘well below’ 2°C warming and ‘preferably’ to limit below 1.5°C, global emissions continue to rise. The focus of COP 27 was about reparations for loss and damage – by richer ‘developed’ countries to poorer ‘less developed’ countries. The Climate Fund is around $100bn a year – a tiny proportion of the profits of global oil companies. At COP 26 in Glasgow, there was a need to set NDCs (Nationally Determined Contributions to emission reduction) in line with 2/1.5°C targets. This didn’t happen and it didn’t happen in COP27 in Sharm el-Sheikh. The 1.5°C target is now effectively dead, the lesson to be learnt is that dramatic action is needed to keep 2°C viable. To do this, the focus needs to shift from net zero carbon production to net zero carbon consumption and at the same time pay proper attention to limiting land use change and conserving the natural environment.

CBAM (Carbon Border Adjustment Mechanism)

The CBAM is a new carbon border tax in the EU. The Carbon Border Adjustment Mechanism will require the importers of certain goods to the EU to buy certificates accounting for carbon emissions based upon rates in the EU’s ETS (Emission Trading System). Likely applying at first to aluminium, steel, iron, electricity, cement and fertilisers the scheme could be extended to other commodities. It is intended to help prevent ‘carbon leakage’ where companies with carbon-intensive operations move production/supply outside the EU to avoid carbon costs and regulation. Reporting on the tariff will begin now (January 2023) and it will take effect in 2026.

Sustainable business challenges –climate

In a changing climate, with some hope remaining for global emissions reductions to arrest the worst of runaway heating, companies will need to have clear, trustworthy, data, information and intentions for emissions reductions towards net zero. As a condition of supply, companies are increasingly required to have Science Based Targets, to have already set Scope 1 and 2 targets, and in 2023, Scope 3 targets for emissions reductions.

Companies need to be responsible for the emissions that they commission through their activity, wherever they arise. For those in target sectors for the CBAM, and for commodity-based enterprises in general, accounting for and addressing through certificates will be increasingly required as the CBAM moves towards taking effect and in the UK moves are made to expand carbon accounting beyond a limited territorial view.

Plastics

Plastics are very visible in the public consciousness. Together with being a useful and often vital material, plastics generate multiple sustainability challenges including carbon impacts, fossil fuel use and of course pollution.

Packaging is a major use of plastics and as a response to the sustainability challenge, EU member states unveiled plans in November 2022 to tackle Europe’s plastic and packaging waste. This made the headlines as a ban on mini-shampoo bottles and single-use coffee cups, but it also extends to mandatory deposit schemes and other packaging reduction requirements.

Under the proposals, some types of packaging considered ‘avoidable’ would be banned and member states would look to reduce packaging waste per capita by 15% by 2040 (against a 2018 baseline).

Sustainable business challenges –plastics

Businesses need to be more conscious of the choices they make about the materials that they use. We have had clients facing requirements to remove plastics from product lines at short notice as a condition of sale. Therefore, businesses need to have good visibility of the use and role of plastic in product portfolios, why is it used (e.g., it might be for reduced weight, food safety etc.) and how it performs in terms of carbon and wider environmental impacts. This lifecycle information can be used to help make decisions on material substitution, and/or increasing the circularity of the plastic used (making more use of recycled materials and enhancing recyclability of waste materials).

Geo-political

After perhaps relative stability for several years, 2021 saw Russia’s invasion of Ukraine and a range of knock-on effects across the world. Sanctions and restrictions meant many businesses severing ties and investments in Russia while the conflict disrupted supplies of sunflower oil and grain amongst many other goods and strategic raw materials. The knock-on effects related to oil and gas purchases from Russia have helped fuel inflation and global economic volatility.

This was an unwelcome and generally unforeseen development, but there are other longer-term geopolitical changes. On a smaller scale, the implications and impacts of Brexit remain to be seen in Europe. China is growing in power, seeking to flex its muscles against a perhaps waning US. The Biden administration has brought the US back into the international climate fold and is now pursuing a more protectionist approach. US/China is the largest geopolitical relationship in the world, it is both difficult and precarious. Biden has actually followed a similar policy trajectory to Trump, the relationship is fractious at times but unlikely to change unless there’s a huge global event. China’s economic growth has been relatively poor, and attempts to emerge from the zero-covid approach have been difficult and are set to provide further ongoing disruption socially and economically.

The China/Russia relationship is also uncomfortable. China has sat on the fence to maintain its relationship with Russia, but its support for the war in Ukraine is ambiguous, having been clear that it strongly opposes the use of tactical nuclear weapons.

The longer-term trend is towards a more complex and uncertain world picture, with the US declining in economic power and emerging countries such as India and Brazil wanting to play a more significant role on the world stage. These two countries will be crucial for progress on climate change. More complex geopolitical risks will require greater dialogue and cooperation, which could be more challenging in a multi-polar world.

Sustainable business challenges –geopolitical

Businesses are subject to rather than in control of geopolitical drivers and events. As most global sustainability challenges require collaboration to best manage and mitigate them, conflict and uncertainty is far from helpful. Supply chain uncertainties move the needle towards greater onshoring for some companies.

Looking positive

There are some reasons to be cheerful (or just a little less miserable), here are a few!

Ozone layer

UN scientists are now predicting the ozone layer will be fully ‘healed’ around 2040 if current progress continues. Ozone provides protection from UV (ultraviolet) radiation. After the discovery of ozone-depleting chemicals (such as chlorofluorocarbons) and the impacts they were having, global regulatory action through the 1987 Montreal Protocol, has led to what could be a rare global environmental win.

Such effective, concerted global action provides hope that similar progress can be achieved on climate, nature and other existential sustainability challenges.

SDGs

The Sustainability Development Goals (SDGs) set targets for global development, reducing environmental damage and achieving social goals. Each of the 17 major goals have related indicators – progress can be explored here. It is not all good news, several indicators are going backwards in certain countries. But digging around (there’s a lot of data there) you can see that there’s a lot of positive progress on many fronts.

Circular economy tractor fuel?

It sounds like bullshit – and it is. New Holland has announced a new tractor that can run on liquified methane. This could help farmers reduce fossil diesel and manage methane emissions from manure. We’d need to see a good analysis of the life cycle impacts to be sure this is truly positive, but it looks interesting (even if it may not smell too good).

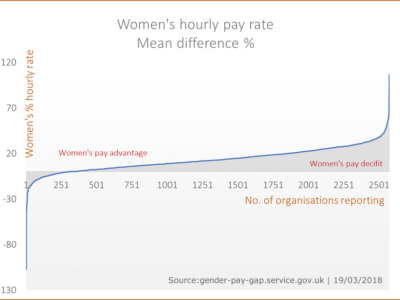

Global inequality

Inflation is squeezing prosperity worldwide and is having severe consequences for standards of living. While we are not downplaying this, there’s a wider context. Inequality within countries has increased with growing globalisation (and a small proportion of people getting much richer). But global inequality has been steadily reducing over the last century. While the Covid pandemic and current inflationary pressures will slow and, in some cases, reverse some progress, we might expect wider trends to continue long term. The greatest challenge will be achieving greater prosperity, for more people, without greater environmental damage or perverse inequalities.

developing strategy / Making plans

Can we help you?

We help companies, charities and NGOs navigate sustainability trends and challenges and build or improve strategies, approaches and plans. They want to develop and meet ambitious objectives, reduce footprint and enhance value.

DISCOVER MORE | Sustainability Issues

Business professional’s guides to sustainability/ESG

ADVANCE your sustainability/ESG approach with these insight-packed free guides

Greenwashing Copy Creator *

Greenwashing Copy Creator *

Leave a Reply