Thought Leadership in Sustainability

Our insights, expertise and thought leadership has featured in leading publications and several of the world’s most recognised sustainability sites worldwide. You can read it here.

Our insights, expertise and thought leadership has featured in leading publications and several of the world’s most recognised sustainability sites worldwide. You can read it here.

Despite considerable regulatory focus on carbon neutral claims, companies are still getting their communications wrong, so what is happening?

While many large companies now appear wary of making claims about carbon neutrality, we can still see considerable focus on these in the SME space, some fuelled by questionable labelling schemes.

This article reviews recent regulatory and best practice developments and explores where businesses have gone wrong.

Reputation is widely regarded as one the most valuable assets of an organisation. Sustainability can also be an important contributor to both reputation and several dimensions of business value.

In this article we explore different dimensions of reputational risk, how it might be affected and how you can protect it.

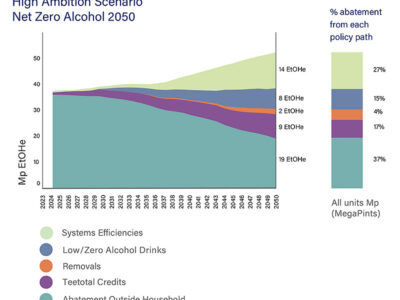

With increasing warnings from scientists, it’s very clear that we must reduce our alcohol use and set a reduction pathway towards Net Zero Alcohol.

To deliver our goal we have identified a strategic framework which will flexibly deploy multiple policy solutions, as appropriate, to realise our vision. So why not pour a glass of your favourite tipple, sit down, and take a read?

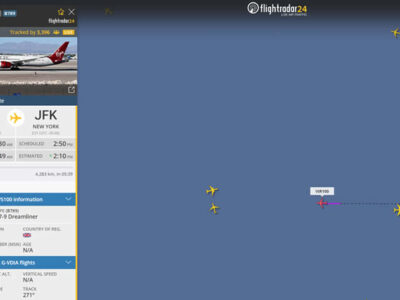

On the 28 November 2023, the first long-haul passenger plane powered with ‘sustainable’ air fuel took off. SAF offers an ostensibly attractive path for decarbonisation for the airline industry – the lifecycle greenhouse emissions can be up to 70% lower than conventional fossil-based fuels.

While this in many ways represents a significant breakthrough (SAF is currently perhaps 0.1% of global aviation fuel use) there are major challenges ahead.

To drive change in their organisations, sustainability professionals have to be effective influencers as well as content experts.

However, navigating how to develop the right messages for the right audiences can present a range of challenges, especially when sustainability can be complex, nuanced, and the subject of assumptions and strong passions.

Understanding the nature and types of communication that are used and valued by different groups, functions and professions in your organisation is fundamental to success.

Even within a single organisation, ways of thinking, cultural norms and professional perspectives can vary widely. Successful sustainability communication needs to recognise and utilise this diversity.

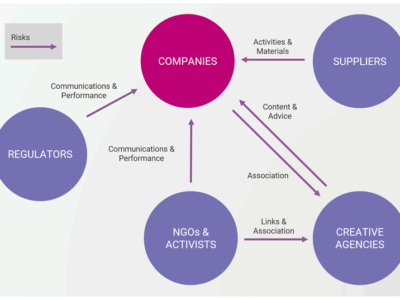

Greenwashing – misleading communications on sustainability issues – has various dimensions of risk, but these are often overlooked, and their implications are insufficiently examined.

While greenwashing may appear as simply irritating, it actually causes a range of harm and presents multiple business risks. Risks to the company which communicates it – but also risks to companies involved in creating it and those associated with it.

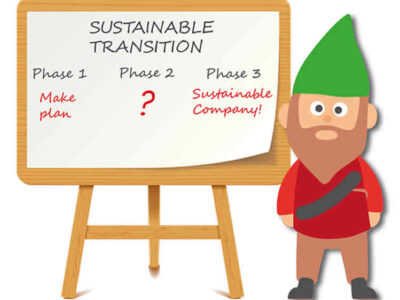

Dramatic changes are needed in business and industry to head off coming poly crises and build a prosperous future for the growing global population.

But plans for this ‘sustainable transition’ are few and far between and often lack credible substance to bridge the link between ambition and action. Indeed, many appear to rely upon an unspecified magical transformative ingredient that will make it all happen – the underpants gnomes.

This article highlights how concerns are mounting about the gap between high level commitments and real change, how action can lag behind the rhetoric of some sustainable transition approaches and explores the essential components of a plausible plan. (you can also find out what an underpants gnome is…).

Worldwide regulators are tightening up on strategic greenwashing to protect consumers, business and market integrity. As further examples arise there is more, we can learn about what regulators will tolerate and what they require of companies.

Put simply, any leeway for general feel-good statements, vague aspirations and unsubstantiated claims has vanished as the focus shifts from products and services to more fundamental strategy.

In this article, we review the major stakeholders with a stake in clamping down on greenwashing, take a look at three recent high-profile cases where adverts have been banned and examine the far-reaching implications of regulatory requirements for companies.

While big picture environmental threats of climate change, nature loss and ecosystem collapse remain long term risks, geopolitical instability and the current cost-of-living crisis challenges present emerging challenges to the chance for global consensus and coordinated action.

The WEF (World Economic Forum) Global Risks Report 2023 presents a picture of how more than 1,200 respondents perceive the global risk landscape, identifies several future scenarios and possible polycrises arising from the complex interactions of a number of individual trends.

What are the Report’s headlines and top 10 short- and long-term risks?

From avoiding greenwashing to facing soaring business costs, 2023 is set to be a challenging year for most business leaders to navigate.

Regulators, customers and consumers have increasing expectations for good quality, consistent information on sustainability. Communication must be accurate and meaningful because greenwashing is getting more dangerous.

Inflation and the cost of borrowing have the potential to push action on climate and sustainability down the agenda, but this is balanced by new regulation for 2023 that will help keep sustainability at the forefront for many business leaders.

As in previous years, the climate and nature crises, new regulations, geopolitical turmoil, and declining biodiversity are not going away. Sustainable business ambitions and plans are indeed facing challenges from fast-changing global conditions.

Terrafiniti’s partners Dominic Tantram and Joss Tantram share insight and opinion on the trends to watch for 2023 –the good, bad and the ugly.

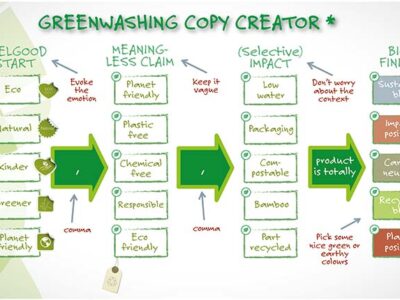

It's tough doing the work of creating truly misleading greenwash. But don't worry, help is here use the Greenwashing Copy Creator (GCC) to hit the eco-friendly target. Definitely not to be confused with the Green Claims Code (GCC) this will really help you knock out vague, misleading and generally crapulous copy - read this to get your own UTI!

Greenwashing is getting dangerous - regulators, customers and consumers have increasing expectations regarding access to good quality, consistent information on sustainability, whether it is about a company’s overall performance, or about specific aspects of a product and how it compares to others. This article explores the context and what you need to consider while attempting to meet growing customer expectations and increasingly fierce regulators.