SPRG NEXT SESSION | Communicating Sustainability – navigating the challenges and building trust

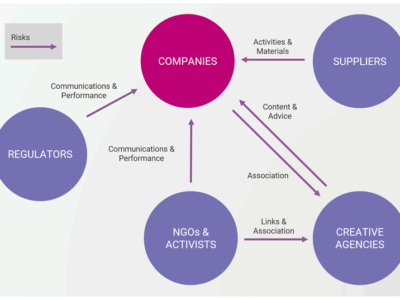

Effective sustainability leadership hinges on clear, consistent communication—both internally and externally. As expectations rise and scrutiny intensifies, businesses must articulate not only their approach but also their performance in ways that resonate with different and diverse audiences.

Yet, getting it right is far from easy. Many sustainability communications fall short—confusing, incomplete, or even misleading. The growing prevalence of greenwashing has made audiences both more sceptical and discerning than ever.